President Trump’s Tax Returns Highlight Deep Economic Inequalities in America

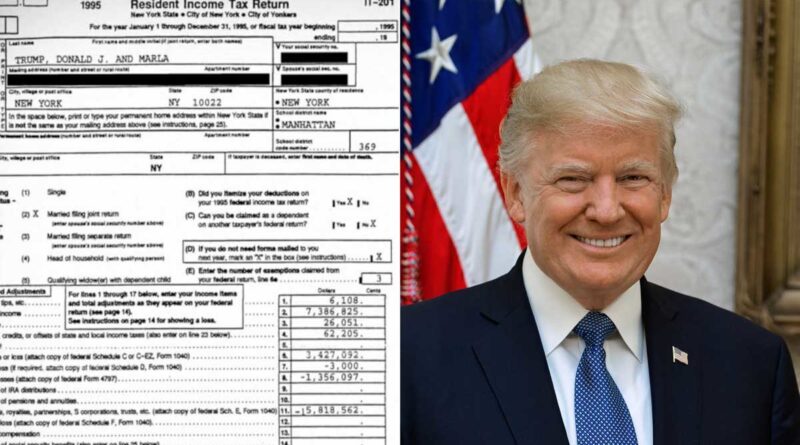

The New York Times released a report Sunday, Sep. 27 that unearthed an answer to a mystery intriguing the American public since before the 2016 election: How much does President Trump pay in taxes?

The answer: Trump, a billionaire, paid only $750 in personal taxes in 2017. Out of the 18 years of finances investigated by the Times, Forbes reports that Trump paid federal taxes for only 11 of them. This was in large part because he claimed the properties he owns were losing more money than they were making. This makes it seem as though President Trump’s finances are in a dismal state, when in reality, the President is making hundreds of millions of dollars by selling his likeness and name to several companies.

People have taken to social media, posting that waiters, nurses, and teachers pay more in taxes than the president. Stephanie Staub, who teaches two Art History courses in addition to AP Psychology, says she paid more than ten times in taxes what Trump paid in 2017. “It makes me feel resentful,” Ms. Staub says, “that this is a person living in gold covered houses, paying far less than myself and his predecessors1 and other presidential candidates.

Scott Mendenhall, fellow social studies teacher who also paid more than $750 in taxes in 2017, says, “It makes me feel pretty upset – the fact that someone so “rich” can get away paying so little in taxes.”

Even some students have paid more in taxes than President Trump did in 2017.

Senior Jillian Kabik, who works as a lifeguard at a retirement facility, says, “It’s really maddening and disturbing to know that a man who has a net worth of a billion dollars paid less in taxes than a 17-year-old girl working a minimum wage job as a lifeguard.”

Senior Michael Gersten says, “Knowing that I paid nearly half of what a [billionaire] paid in 2017 in taxes as a minimum wage Starbucks barista is very frustrating to say the least.”

President Trump also allegedly made hundreds of millions more from his reality television show, The Apprentice, from a marketing deal with a firm reported to have exploited investors, and from a significant tax refund in 2010. This tax refund, for $72.9 million, is being investigated by the Internal Revenue Service (IRS). He claimed private plane rides and expensive hairstyles among work-related expenses that could be written off.

Ms. Staub adds, “We should close these [deduction] loopholes and … eat the rich.”

“I think Trump is doing what the majority of billionaires or super-wealthy do: manipulating the tax code to their advantage,” Mr. Mendenhall adds. “This Trump tax story is a perfect example of the economic inequalities that exist in the U.S. My hope is that the story gives further momentum to the Democrats (if they do regain control of government) to make real and substantial changes to the tax code to make sure no billionaire gets away paying so little in taxes.”

Forbes writes that should Trump’s taxes be found fraudulent, he could be imprisoned. While Trump may try to pardon himself from the central government’s charges, he cannot do anything about the separate investigations into his finances being run on the state level. The New York Attorney General, Letitia James, is currently investigating Trump for tax fraud.

The Times reports that President Trump owes more than $420 million in debt, which he will have to pay in the next four years.

President Trump has claimed he’s paid much more in taxes than the Times reports and calls these allegations part of a “witch hunt” by the “lamestream media.” However, his opponent in the 2020 presidential election, former Vice President Joe Biden, has capitalized on this bombshell.

Vice President Biden has begun printing pins supporters can wear to boast they pay more in taxes than their billionaire president, and staffers have created an online engine to check whether or not voters have paid more in taxes than Trump.

Trump has tried to save face by denying the validity of the reports and investigations, as aforementioned, but also by citing that he is the only president to ever turn down the yearly $400,000 salary. However, that does not offset his debt, nor does it erase the amount of money his personal expenses have cost taxpayers since 2016. Millions of taxpayer dollars have funded the President’s golf trips and visits to his private Florida resort, Mar-A-Lago.

How the revelation of this information has ultimately influenced voters’ decisions this election cycle is uncertain, but according to polls posted by CNN, Biden has continued to solidify his lead ever since the news broke.

1 According to Mr. Mendenhall, who references an historian’s Twitter post, President Abraham Lincoln paid more in taxes in the 1860s (around $1,200 a year) than President Trump did.